Table of Contents

Introduction:

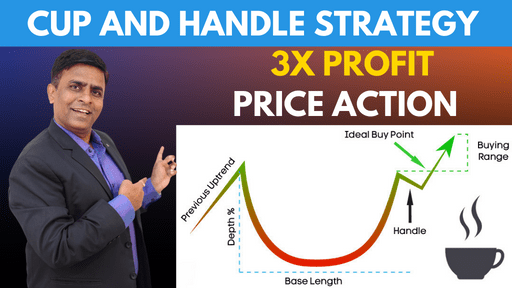

Welcome to the exciting world of trading, where patterns emerge like hidden treasures, waiting to be discovered by savvy traders. Among the arsenal of chart formations, one stands tall as a beacon of bullish opportunity – the Cup and Handle pattern. If you’re seeking a winning strategy to navigate the stock market’s wild seas, look no further. In this blog, we’ll take you on an exhilarating journey to unlock the secrets of the Cup and Handle pattern, empowering you with the knowledge to spot this powerful formation, strategize your trades, and target profits like a seasoned pro. So, grab your mug of inspiration, and let’s set sail on a voyage to trading success!

KeyPoints

- Cup and Handle Pattern: The cup and handle is a bullish technical chart pattern that resembles a cup with a handle. It is used to spot opportunities to go long in a security.

- Formation Timeframe: The pattern’s formation can be as short as seven weeks or as long as 65 weeks, offering traders opportunities in both short and long-term timeframes.

- Pattern Characteristics: A strong cup and handle pattern has a “U” shaped cup with a shallow and rounded bottom, followed by a handle with a slight downward drift.

- Volume Analysis: Volume plays a crucial role in confirming the pattern’s strength. Volume should decrease during the cup formation and increase when the stock breaks out of the handle.

- Trading Strategy: Traders can enter a long position by placing a stop buy order just above the upper trendline of the handle. Alternatively, they can wait for a close above the handle’s upper trendline and place a limit order slightly below the breakout level.

- Profit Target: The profit target is determined by measuring the distance from the bottom of the cup to the breakout level and extending it upward from the breakout point.

- Stop-Loss Placement: Traders can place stop-loss orders either below the handle or below the cup, depending on their risk tolerance and market volatility.

- Limitations: Like all technical indicators, the cup and handle pattern should be used in conjunction with other signals and indicators. Its formation time can vary, and it may not work well in illiquid stocks.

What is the Cup and Handle Pattern?

The Cup and Handle pattern is a bullish continuation pattern that resembles a cup and handle on a price chart. It is a technical analysis tool used by traders to identify potential upward price movements in a stock or asset.

To identify this formation, look for two key elements:

- The Cup: The first part of the pattern is the cup, which typically has a rounded bottom. It resembles a “U” shape on the chart and signifies a temporary pullback in the stock’s price after an uptrend. The cup formation should be at least 30% deep, but not more than 50%. Think of it as the price taking a breather before it gears up for the next leg of its upward journey.

- The Handle: Following the completion of the cup formation, the stock’s price undergoes a small and short-lived decline, creating a handle. The handle is a relatively narrow trading range, sloping slightly downward or sideways, and often appears as a small dip on the chart. It signifies a period of consolidation before the price takes off on a new uptrend.

The Cup and Handle pattern is considered a powerful bullish signal, indicating that the stock is likely to resume its upward trajectory after the temporary pause.

How to Trade the Cup and Handle Pattern

Sure! Here are some attractive key pointers to help you trade the Cup and Handle pattern like a pro:

- Spot the Golden Cup: Train your eyes to identify the Cup formation, resembling a beautiful “U” shape on the chart. This rounded bottom signifies a temporary pullback, setting the stage for potential gains.

- Handle with Care: Look for the handle formation, a short-lived dip after the cup. It’s like the stock takes a breath before embarking on its upward journey. Keep an eye on the handle’s price range within the upper half of the cup for that extra bullish confirmation.

- Volume: The Symphony of Success: High trading volumes during the cup and handle formation are like music to a trader’s ears. Increased interest signals a stronger likelihood of a successful breakout.

- Breakout Time: The moment you’ve been waiting for! When the stock price breaks above the handle’s resistance, it’s time to take action. Enter your position confidently as this signals the end of consolidation and the start of a potential uptrend.

- Keep Your Safety Net: Protect your hard-earned gains by setting a stop-loss order just below the handle’s support level. A safety net ensures you exit gracefully if the sentiment takes an unexpected turn.

- Mix and Match: Like a master chef, combine the Cup and Handle pattern with other technical indicators for a winning recipe. Blend the signals to maximize your success rate.

- Patience Pays: Trading is an art that rewards patience. Wait for the pattern to fully form and confirm before taking action. Rushing in can lead to bitter outcomes.

- Practice, Practice, Practice: Just like any skill, practice makes perfect. Start with paper trading or using demo accounts to gain confidence before diving into live trades.

A Practical Example: Trading the Cup and Handle Pattern

FAQs: Unraveling the Cup and Handle Pattern

Q1: Are there variations of the Cup and Handle pattern?

Yes, variations of the Cup and Handle pattern exist, such as the Inverted Cup and Handle and the Deep Cup and Handle. Each variation possesses similar characteristics but with slight differences in their formations.

Q2: Can the Cup and Handle pattern occur in any timeframe?

The Cup and Handle pattern can appear in various timeframes, from intraday charts to monthly charts. However, the pattern’s significance and reliability tend to increase with higher timeframes.

Q3: Are Cup and Handle patterns foolproof?

While the Cup and Handle pattern is a robust bullish signal, no trading pattern is entirely foolproof. It is essential to combine technical analysis with risk management strategies and consider other market factors before making trading decisions.

Q4: Can the pattern be traded in any financial market?

Yes, the Cup and Handle pattern is not limited to stocks alone. It can appear in other financial markets, such as commodities, forex, and cryptocurrencies, making it a versatile tool for traders across different assets.

Q5: How long does it take for the pattern to play out?

The duration for the Cup and Handle pattern to play out can vary. It could take a few weeks to several months, depending on the timeframe of the chart and the stock’s price behavior.

Wrapping Up: Mastering the Cup and Handle Pattern

In conclusion, mastering the art of trading with the Cup and Handle pattern can be a game-changer for any trader. By identifying this bullish continuation pattern and using it to your advantage, you can enhance your trading skills and increase your potential for profit. Remember to follow the step-by-step approach and conduct thorough technical analysis before making your move.

So, the next time you’re sipping your favorite brew at your trading desk, keep an eye out for the Cup and Handle formation – it might just be the perfect signal to brew up some significant gains!

Disclaimer:

The information provided in this blog post is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy or sell any securities. Always do your own research and consult with a qualified financial advisor before making investment decisions.

Also Read: Unlocking the Top Secrets of the Inverse Head and Shoulders Pattern

External Resources : Cup and Handle