Table of Contents

Introduction:

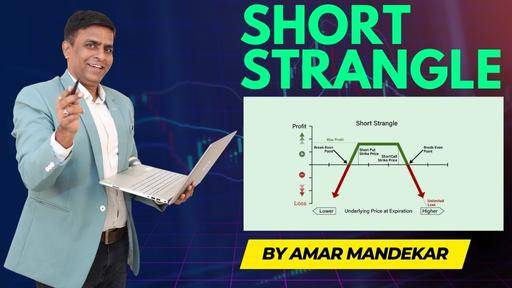

How do you tackle the wild and unpredictable nature of financial markets while aiming for remarkable profits? Enter the Short Strangle option trading strategy, a daring and strategic method that empowers traders to capitalize on volatility and unlock tremendous gains. In this guide, we’ll delve into the depths of this unconventional approach, providing you with valuable insights, tips, and techniques to navigate the dynamic world of options trading like a seasoned pro.

Key Points

- Short Strangle Definition: A Short Strangle is an options strategy where the investor simultaneously sells an out-of-the-money call (higher strike) and an out-of-the-money put (lower strike) on the same underlying asset with the same expiration date.

- Profit Objective: The Short Strangle aims to profit from little or no price movement in the underlying stock.

- Strategy Execution: The Short Strangle is established for a net credit (or net receipt) by selling both the call and put options. It benefits from a narrow range of stock price movement between the break-even points.

- Limited Profit Potential: The maximum profit is limited to the total premiums received (net credit) for selling the options, minus commissions.

- Unlimited Risk: The Short Strangle carries unlimited risk on the upside if the stock price rises significantly and substantial risk on the downside if the stock price falls significantly.

- Breakeven Points: There are two breakeven points for the Short Strangle, calculated as the higher strike price plus the total premium received and the lower strike price minus the total premium received.

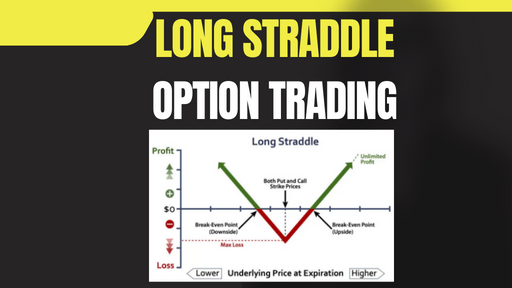

- Comparison to Straddle: Short Strangles are often compared to Short Straddles, and each strategy has its advantages and disadvantages in terms of potential profit, breakeven points, and sensitivity to time decay.

- Impact of Stock Price Change: The Short Strangle has a near-zero delta for small changes in stock price between the strike prices. However, it can lose money if the stock price moves significantly in either direction.

- Impact of Change in Volatility: Short Strangles tend to increase in price and lose money when volatility rises. They decrease in price and make money when volatility falls.

- Potential Risk of Early Assignment: Short Strangles carry the risk of early assignment, which can lead to the creation of long or short stock positions. Traders must consider this when managing the strategy.

What is the Short Strangle Option Trading Strategy?

Let’s dive right into the heart of the matter. The Short Strangle options trading strategy that involves selling both a call option and a put option on the same underlying asset, with different strike prices. This strategy is ideally suited for neutral to slightly volatile markets, where the trader anticipates limited movement in the underlying asset’s price.

Unlike more conservative strategies like covered calls or protective puts, the Short Strangle allows traders to profit from a sideways market, making it a valuable addition to any seasoned trader’s arsenal. By employing this strategy, you can generate income through premium collection while embracing the potential risks associated with market fluctuations.

Unleashing the Profit Potential

- Optimal Strike Price Selection:

- Choose slightly out-of-the-money strike prices for both call and put options.

- Maximize premium collection while allowing room for underlying asset’s movement.

- Reflect a relatively stable market outlook.

- Time is of the Essence:

- Benefit from time decay as an option seller.

- Each day erodes the value of the sold options, aiding profitability.

- Balance time decay advantage with monitoring the market to manage risks.

- Navigating Market Volatility:

- Volatile markets offer both opportunities and risks.

- Master handling market volatility to excel in the strategy.

- Adapt and respond effectively to changing market conditions.

- Implementing Stop-Loss Orders:

- Mitigate potential significant losses caused by market volatility.

- Set predetermined stop-loss orders to automatically close positions.

- Safeguard capital for future opportunities and risk management.

- Staying Informed and Adaptive:

- Power lies in staying informed with market news and indicators.

- Anticipate potential price movements to make informed decisions.

- Be ready to adjust strategies and exit positions when needed.

FAQs

Q What is the risk profile of the Short Strangle?

A: The Short Strangle’s risk profile is characterized by limited profit potential but significant risk. The potential profit is capped at the premium collected, while the potential loss is theoretically unlimited if the underlying asset’s price experiences a substantial move in either direction.

Q Can the Short Strangle be used in all market conditions?

A: While the Short Strangle is most effective in neutral to slightly volatile markets, it can be adapted to different market conditions. However, it’s crucial to understand that employing this strategy in highly volatile markets may expose you to higher risks, which should be managed accordingly.

Q How do I calculate the breakeven points?

A: To calculate the breakeven points for the Short Strangle, add the total premium collected from both the call and put options to the call option’s strike price (for the upside breakeven) and subtract it from the put option’s strike price (for the downside breakeven).

Closing Thoughts: Conquering the Markets with the Short Strangle

As we wrap up this exhilarating journey into the realm of the Short Strangle option trading strategy, you should now be equipped with valuable insights and techniques to harness its potential and capitalize on market volatility. Remember, success in options trading requires discipline, adaptability, and a deep understanding of market dynamics.

So, go forth with confidence, embrace the challenges, and be fearless in your pursuit of profit. The Short Strangle is a powerful tool, but like any weapon, it requires skill and finesse to wield it effectively. Practice, learn from your experiences, and continue to expand your knowledge as you traverse the ever-changing landscape of the financial markets.

Now, set sail on your options trading journey, ready to seize opportunities, face challenges head-on, and unleash the potential of the Short Strangle like a seasoned trader.

Disclaimer:

The information provided in this blog post is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy or sell any securities. Always do your own research and consult with a qualified financial advisor before making investment decisions.

Also Read : Options Trading Strategies You Must Master to Boost Your Success