Table of Contents

Introduction

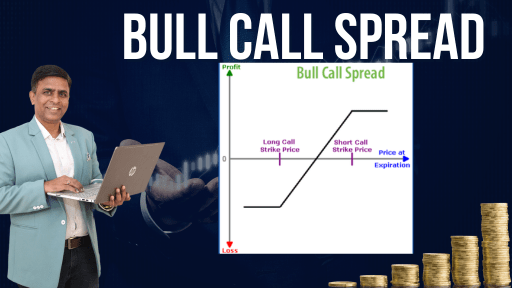

Hey traders! Are you tired of missing out on opportunities in bullish markets? Well we’ve got just the solution for you! The Bull Call Spread is a fascinating options trading strategy that can help you ride the bullish wave with confidence and boost your portfolio’s performance like never before.

In this article, we’ll dive deep into the world of Bull Call Spreads and show you exactly how this strategy works. Whether you’re a seasoned trader or just starting, this guide will arm you with the essential insights to make informed decisions and maximize your profits.

Key Points

- What is it? A bull call spread is an options trading strategy used when a trader believes a stock will have a limited increase in price.

- Strategy Components: The trader buys one call option with a strike price above the current market price and simultaneously sells one call option with a higher strike price but the same expiration date.

- Cost Reduction: The premium received from selling the call option offsets the premium paid for buying the call option, reducing the overall cost of the strategy.

- Limited Risk: The losses are limited to the net cost of creating the spread, providing downside protection.

- Capped Gains: The gains are limited to the difference between the two strike prices minus the net cost.

- Timeframe: Traders use this strategy over short to medium-term periods when they expect moderate price appreciation.

- Lower Premium: Compared to buying an individual call option outright, the bull call spread is a cheaper alternative.

- Profit Scenarios: If the stock price at expiry is below the lower strike, both options expire worthless, resulting in a loss equal to the net cost. If the stock price at expiry is above the higher strike, both options are exercised, and the profit is capped at the difference between the strikes minus the net cost.

- Suitable Market Conditions: Traders often employ the bull call spread during times of high volatility when they expect a gradual rise in the stock’s price.

- Delta and Gamma: The bull call spread’s delta is net positive, reflecting the increase in the underlying asset’s price. However, its gamma is close to zero, indicating minimal changes in premiums as the underlying asset’s price fluctuates.

What is a Bull Call Spread?

A Bull Call Spread is an options trading strategy that involves buying a call option and simultaneously selling another call option with a higher strike price. This strategy is employed when a trader is bullish on a particular stock or asset and expects its price to rise in the near term.

How does it work, you ask? Well, let’s break it down step by step:

- Buying the Call Option: The first part of the Bull Call Spread involves purchasing a call option. A call option gives the holder the right, but not the obligation, to buy the underlying asset at a specified price, known as the strike price, on or before the expiration date. This allows you to profit from an increase in the stock’s price.

- Selling the Call Option: Simultaneously, you sell another call option with a higher strike price than the one you bought. This step helps offset the cost of the purchased call option and limits the overall risk of the trade. The call option you sell is also known as the “short call.”

By combining these two actions, you create a Bull Call Spread, which is sometimes referred to as a “debit spread” because you initially pay a premium to open the position.

The Beauty of the Bull Call Spread

Now that you understand the mechanics, let’s explore why the Bull Call Spread is a favorite strategy among traders:

- Limited Risk, Unlimited Potential: One of the biggest advantages of the Bull Call Spread is its limited risk. Since you’re simultaneously buying and selling call options, the premium you paid for the lower strike call is partially offset by the premium you received from selling the higher strike call. This reduces the overall cost of the trade and limits your potential losses.

- Benefiting from Bullish Trends: The Bull Call Spread thrives in bullish market conditions. If your analysis proves correct, and the underlying asset’s price rises above the higher strike price, both call options will be in the money, resulting in a profitable trade.

- Flexibility in Profit Target: Unlike simply buying a call option, the Bull Call Spread allows you to have a specific target for your profit potential. This target is determined by the difference between the two strike prices minus the net premium paid. It provides a clear and predefined goal, aiding in disciplined trading.

- Reduced Impact of Volatility: As an options trader, volatility can be your friend or foe. The Bull Call Spread benefits from reduced volatility risk due to the simultaneous sale of the higher strike call option, which partially hedges against price swings.

How to Execute a Bull Call Spread?

Executing a Bull Call Spread may seem daunting at first, but fear not! We’ll guide you through the process, step by step:

- Step 1: Choose the Underlying Asset: Start by identifying an underlying asset that you believe will experience bullish price movement. Conduct thorough research, analyze market trends, and rely on technical and fundamental indicators to make an informed choice.

- Step 2: Select the Strike Prices and Expiration Date: Once you’ve chosen the asset, determine the strike prices for your Bull Call Spread. The lower strike price is the one you’ll buy, while the higher strike price is the one you’ll sell. Choose an expiration date that aligns with your market outlook.

- Step 3: Calculate the Maximum Profit and Loss: Before placing the trade, it’s essential to understand the potential outcomes. Calculate the maximum profit and loss of the Bull Call Spread using the strike prices and the net premium paid.

- Step 4: Place the Trade: With your analysis complete, it’s time to place the Bull Call Spread trade. You can use a trading platform or work with a broker to execute the strategy. Make sure to enter the correct strike prices and expiration date to avoid any mishaps.

- Step 5: Monitor and Manage the Trade: Once the trade is live, keep a close eye on the underlying asset’s price movement and any changes in market conditions. You may choose to exit the trade early if your profit target is met or adjust your position if the market moves unexpectedly.

FAQs about the Bull Call Spread

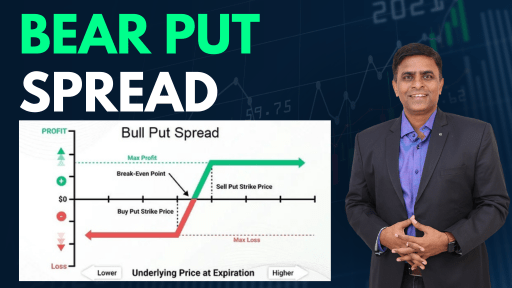

Q1: Can I use the Bull Call Spread in a bearish market? A: The Bull Call Spread is specifically designed for bullish market conditions. In a bearish market, where you expect the asset’s price to decline, other strategies like the Bear Put Spread or simply buying put options may be more suitable.

Q2: Is the Bull Call Spread suitable for beginners? A: Absolutely! The Bull Call Spread is a relatively straightforward strategy and can be a great starting point for beginners to learn about options trading. Just ensure you have a clear understanding of the underlying asset and conduct proper research before executing the trade.

Q3: What happens if the underlying asset’s price remains stagnant? A: If the asset’s price remains close to the lower strike price at expiration, both call options may expire worthless, resulting in a loss equal to the net premium paid.

Q4: Can I adjust the Bull Call Spread after placing the trade? A: Yes, you can make adjustments to the Bull Call Spread based on changes in the market or your outlook. For example, you might choose to close the trade early if your profit target is achieved or roll the strategy to a future expiration date.

In Conclusion

The Bull Call Spread is a brilliant options trading strategy that empowers traders to profit in bullish markets while limiting risk. Its versatility, potential for substantial gains, and straightforward nature make it a sought-after choice for traders of all levels.

As with any trading strategy, it’s crucial to conduct proper research, manage risk effectively, and stay disciplined.

Disclaimer:

The information provided in this blog post is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy or sell any securities. Always do your own research and consult with a qualified financial advisor before making investment decisions.

Also Read : Options Trading Strategies You Must Master to Boost Your Success

External Resources : Bull Call Spread